Best Metals to Invest in 2025

With recession fears rising and market volatility increasing, many investors are searching for ways to preserve wealth and hedge against economic downturns. Memories of the 2008 financial crisis—when markets lost over half their value—remain fresh, prompting a renewed interest in stable assets.

During past crises, precious metals like gold and silver proved to be reliable safe-haven assets, often outperforming stocks and offering long-term value. This has many wondering: which metals to invest in now?

>>> Click here to learn more about Best Metals to Invest in 2025 <<<

The modern precious metals market is broader and more complex than ever, offering various investment products such as bullion, coins, ETFs, and mutual funds. As you refine your investment strategy, choosing the right metal—whether gold, silver, platinum, or palladium—can play a key role in helping diversify your precious metals portfolio and mitigate risks.

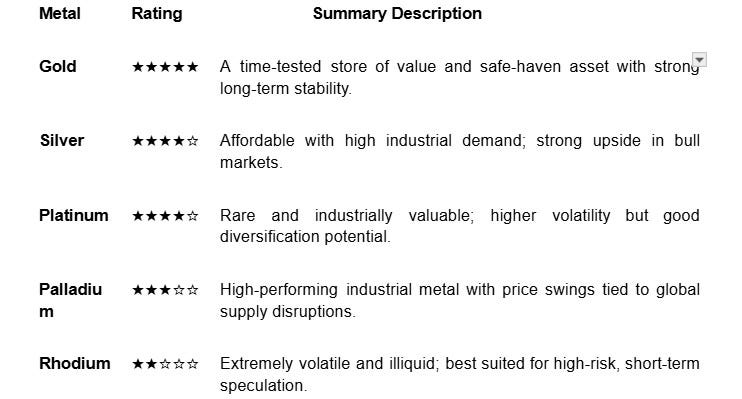

At a Glance: Best Metals to Invest in 2025

Quick Highlights

Gold is known for its enduring value and consistent long-term growth.

Silver often outperforms gold during bullish market cycles, offering impressive upside potential.

Other precious metals can deliver substantial returns—but they come with significantly higher risk.

Understanding Precious Metals

Precious metals are rare elements with extensive industrial applications and strong demand in both investment portfolios and sectors like jewelry and technology. Their scarcity and ability to retain value set them apart from base metals such as copper or steel.

While gold and silver are the go-to metals for many, investors seeking diversification should consider platinum group metals—like platinum, palladium, and rhodium. These metals not only serve in catalytic converters and industrial use but also offer opportunities for higher returns and wealth preservation.

So, which precious metal aligns with your financial goals and risk tolerance? Here are four standout options to help diversify your precious metals portfolio.

1. Gold – The Timeless Standard

Among the most reliable options in a precious metals portfolio, gold continues to stand out as a cornerstone investment. Its reputation as a safe-haven asset has endured through centuries, making it a go-to metal for those looking to preserve wealth and hedge against economic uncertainties.

Gold’s stability, liquidity, and ability to retain value—even during financial crises—make it especially appealing during times of market volatility. Compared to paper currency, which loses purchasing power, gold has consistently increased in worth. Investors can further enhance their strategy by holding physical gold through a self-directed gold IRA.

Key benefits of investing in gold:

Acts as a long-term store of value

Protects against inflation and recession

Offers liquidity and global recognition

Helps diversify your precious metals portfolio

Can be held in tax-advantaged gold IRAs

Historically outperforms during economic downturns

Available in bullion or coins for flexible investing

2. Silver – Versatile and Affordable

While gold may lead in reputation, silver offers its own unique advantages—especially for those aiming to diversify their precious metals portfolio. Often underestimated, silver combines affordability with strong industrial demand, making it a powerful asset in both stable and uncertain markets.

Historically, silver has delivered higher returns than gold during precious metal bull runs. Following the 2008 crisis, silver prices jumped over fivefold—outpacing gold’s growth. Its value is closely tied to various industrial applications, including electronics, solar panels, and medical technology.

With industrial demand rising and silver supply constrained due to its byproduct nature, silver is well-positioned for long-term value and potential price breakout. Like gold, it also qualifies for a silver IRA, allowing investors to hold physical bullion or coins within a tax-advantaged account.

Key benefits of investing in silver:

Higher return potential in bull markets

Extensive industrial use in fast-growing sectors

More affordable entry point than gold

Increasing demand paired with shrinking supply

Eligible for silver IRAs to support retirement goals

Supports diversification and wealth preservation

Acts as a hedge against economic crises and inflation

3. Platinum – Rare and Resilient

After silver, platinum stands out as another strategic choice for those looking to diversify their precious metals portfolio. Though not as widely known as gold or silver, platinum offers unique value due to its rarity, industrial demand, and potential for higher returns.

Known for its strength, shine, and corrosion resistance, platinum is widely used in various industrial applications—from high-end jewelry to catalytic converters in the automotive industry. Roughly half of global platinum output is dedicated to reducing vehicle emissions, making it a key player in both traditional and electric vehicles.

Platinum's supply is concentrated in just a few countries—primarily South Africa, with contributions from Russia and Zimbabwe. This geographic dependency heightens the risk of supply disruptions, often leading to price volatility. Still, its limited availability in bullion or coins adds to its appeal as a rarer and potentially undervalued asset.

Key benefits of investing in platinum:

Strong industrial demand, especially in automotive and industrial sectors

Potential for long-term value and price recovery

Greater scarcity compared to gold and silver

Historically traded above the price of gold

Useful for diversification and inflation hedging

Suitable for investors seeking alternatives with limited investment options

4. Palladium – The Industrial Powerhouse

Following platinum, palladium is another metal with extensive industrial applications—especially in the automotive industry. Though once used primarily in jewelry, palladium is now essential for catalytic converters, making it highly valuable despite its price volatility.

Palladium’s supply is geographically concentrated, with Russia and South Africa leading global production. This industrial dependency and limited sourcing make prices highly sensitive to geopolitical events and economic instability.

Over the years, supply disruptions have triggered sharp price swings. In 2022, fears of restricted Russian exports drove prices above $3,400 per ounce—before falling below $1,000 as supply concerns eased and demand softened.

Palladium has historically been the more affordable alternative to platinum, prompting automakers to switch metals, which in turn spiked demand. Though prices are lower today, any renewed sanctions or instability could create a swift rebound.

Key benefits of investing in palladium:

High industrial demand, especially in automotive applications

Strong potential for price appreciation during supply disruptions

Useful for diversification in a precious metals portfolio

Rarer and less saturated market than gold or silver

Sensitive to global economic and geopolitical shifts

Potential hedge during periods of supply constraint and inflation

Bonus Pick: Rhodium – The Hidden Gem

While not as prominent as gold, silver, platinum, or palladium, rhodium still holds a place in the precious metals market—primarily due to its extensive industrial use in catalytic converters. Around 80% of global rhodium supply supports the automotive industry, with most production coming from South Africa.

This industrial dependency and limited sourcing have led to extreme price swings. Rhodium soared to nearly $30,000 per ounce in 2021 amid supply shocks—only to drop to around $4,500 later. Its high price volatility makes it more suitable for short-term speculation than long-term wealth preservation.

Rhodium also faces practical investment challenges. It's not commonly minted into bullion or coins, limiting liquidity and accessibility. In addition, it's not approved for inclusion in precious metals IRAs, unlike gold, silver, platinum, and palladium.

Key points on rhodium:

High price volatility with limited investment options

Strong industrial demand, especially in the automotive sector

Not a store of value like gold or silver

Not eligible for precious metal IRA inclusion

Best suited for high-risk, high-reward investment strategies

Scarcity could lead to future price spikes

Choosing the Best Precious Metal for Your Needs

Choosing the best metal to invest in depends on your financial goals, market outlook, and risk tolerance. For many, gold remains the preferred choice thanks to its long-term value, price stability, and role as a reliable store of wealth. It’s especially ideal for those focused on wealth preservation and minimizing risk during economic downturns.

Investors seeking higher returns may favor silver, which often delivers strong performance during bull markets and remains more affordable. Those comfortable with market fluctuation might also examine platinum and palladium—metals with greater volatility but strong industrial demand and potential for growth.

Ultimately, the right precious metal for your investment portfolio is the one that supports your strategy, helps diversify your precious metals holdings, and aligns with your financial objectives.

Final Thoughts

As economic uncertainties persist, precious metals continue to offer a reliable path for diversification and long-term value. From the resilience of gold to the industrial edge of platinum and palladium, each metal brings distinct advantages depending on your financial goals and risk tolerance.

>>> Click here to learn more about Best Metals to Invest in 2025 <<<

Taking the time to examine these options now could quietly strengthen your investment strategy for the years ahead.