Convert IRA to Gold 2025

How to Convert Your IRA to Gold in 2025: Key Facts Every Investor Should Know

How to Convert Your IRA to Gold in 2025

Americans currently hold over $15.2 trillion in IRA accounts, making this one of the most widely used tools for saving for retirement. However, like all financial assets, IRA assets are not immune to market risks and potential losses.

This raises a key question for many: how can individuals protect their investment within an IRA? A growing number of Americans are examining the option of investing in physical precious metals like gold or silver to help preserve the value of their retirement funds.

Yet, if you try to buy gold directly through your current IRA provider, you'll likely come up short. So, what’s the process for converting your IRA into gold or other precious metals?

>>> Click here to learn more about how to convert IRA to gold <<<

At a Glance: Converting an IRA to Gold

Brief Overview

Gold IRAs operate under the same regulatory framework as traditional IRAs.

They offer the benefit of holding physical gold within a tax-advantaged retirement structure.

You can quickly and easily fund a gold IRA through a tax-free rollover from an existing retirement account.

Understanding IRAs

Individual Retirement Accounts (IRAs), established under the Employee Retirement Income Security Act of 1974, have long served as a valuable tool for building retirement savings and planning for retirement.

Over time, legislation has shaped IRAs into two primary types: Traditional IRAs and Roth IRAs.

Traditional IRA: Funded with pre-tax income, allowing investments to grow tax-deferred. Taxes are applied to withdrawals during retirement.

Roth IRA: Funded with after-tax dollars. Growth is tax-free, and qualified withdrawals in retirement are completely tax-free.

IRAs provide broader investment flexibility than many employer-sponsored retirement plans, like 401(k)s. However, for some, standard investment options may feel limiting—leading to alternative strategies like Gold IRAs.

Understanding Gold IRAs

A Gold IRA functions like a standard IRA, but instead of holding traditional assets, it holds physical precious metals—typically gold or silver—in a self-directed IRA account.

Key Advantages of a Gold IRA

Strengthen Your Portfolio Through Diversification

Investors often diversify portfolios to reduce risk. Physical metals help offset potential losses when other assets are underperforming.

Potential for Asset Appreciation

Gold reached multiple all-time highs in the 2020s. In 2024 alone, it set 40 new record highs—proving itself as both a store of value and a growth vehicle.

Gold as a Safe Haven

Gold remains a reliable safe haven during economic instability. Both central banks and individual investors are buying gold to hedge against volatility in their retirement plans.

Key Regulations for Gold IRAs

Gold IRAs follow the same regulatory rules as traditional and Roth IRAs. However, it's important to understand:

What Types of Assets Can a Gold IRA Hold?

Under 26 U.S.C. 408(m)(2), IRAs cannot hold collectibles, but certain coins and metals are exempt, including:

American Gold and Silver Eagles

Bullion made of gold, silver, platinum, or palladium (minimum .995 fineness for gold)

Distribution Rules for Gold IRAs

Withdrawals before age 59½ may incur a 10% penalty + income tax.

RMDs (Required Minimum Distributions) start at age 73 for Traditional IRAs.

Roth IRAs have no RMDs, but earnings may be taxed if the 5-year rule isn't met.

Funding Your Gold IRA

Annual contribution limits (2024 & 2025):

Up to $7,000

Up to $8,000 if age 50 or older

Rollovers from accounts like 401(k), 403(b), TSP, or other IRAs are not subject to these limits.

A direct rollover is often tax-free and enables flexible funding for a precious metals IRA.

How the Gold IRA Rollover Process Works

Set up a self-directed gold IRA with a qualified custodian.

Contact your current IRA provider or plan administrator to initiate the rollover.

Complete paperwork and provide necessary transfer details.

Transfer funds (typically within 1–3 weeks).

Purchase gold/silver using the funds and store them in a secure depository.

Some providers offer a Buyback Guarantee for flexibility when you're ready to sell.

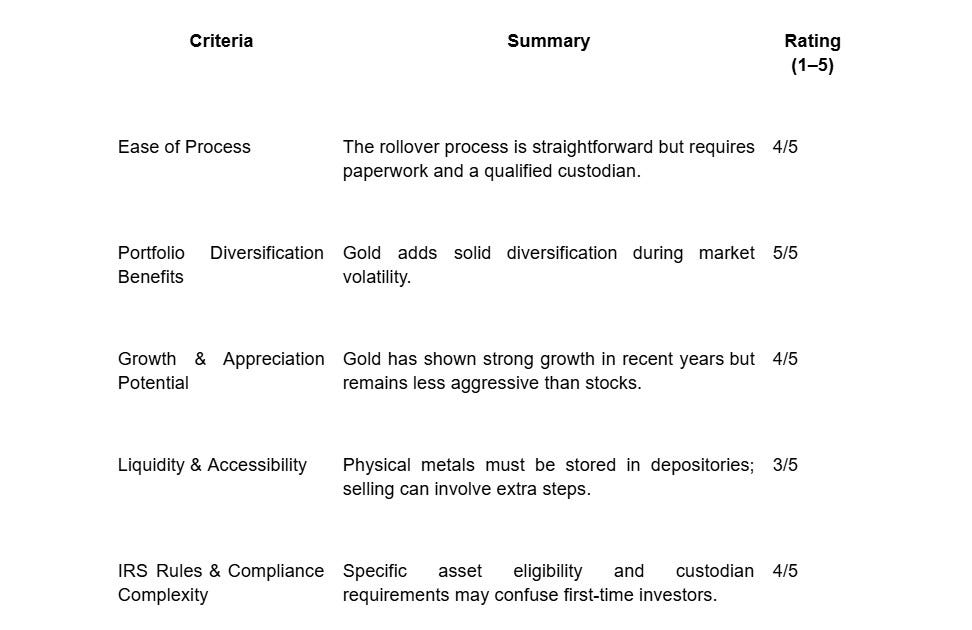

Is a Gold IRA the Right Choice for You?

Ask yourself:

Are you confident in the economy’s stability?

Would you rather safeguard your savings now or recover from future losses?

Are you nearing retirement, or do you still have years to grow your savings?

If you value diversification, long-term protection, and physical asset stability, a Gold IRA may be a smart move.

>>> Click here to learn more about how to convert IRA to gold <<<

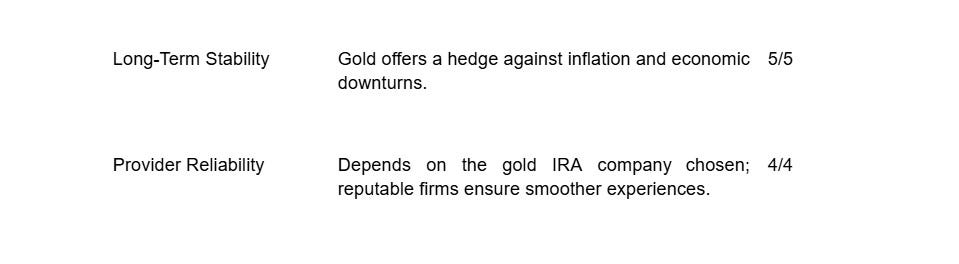

Final Thoughts

Converting your IRA into gold or other precious metals can be a strategic way to diversify your portfolio and protect your retirement savings.

If long-term stability, exposure to gold, and physical asset security are your goals, opening a gold IRA may be the right path forward.