Gold IRA Reviews: Top Gold IRA Companies of 2025

Gold IRAs allow investors to hold physical gold and silver in a self-directed retirement account, offering a hedge against inflation and market volatility. With providers like Noble Gold, Birch Gold Group, and American Hartford Gold offering varying fees and services, choosing the right company can be difficult. This guide highlights the best gold IRA companies of 2025, helping investors compare options, evaluate setup and storage fees, and select a provider that fits their retirement goals.

Top-Rated Gold IRA Companies Featured in This Guide

American Hartford Gold (Best for First-Time Precious Metals Investors)

Birch Gold Group (Best for a Wide Range of Precious Metals Options)

Lear Capital (Best for Real-Time Market Tools and Data Access)

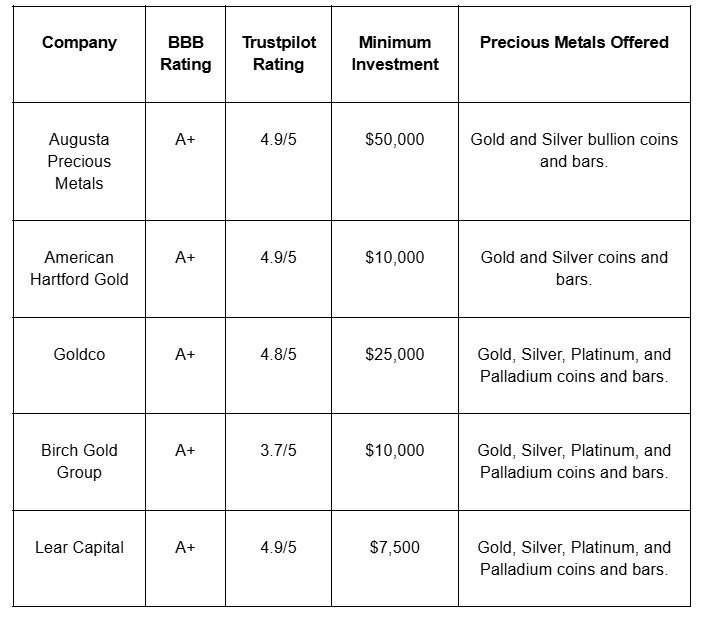

Leading Gold IRA Providers

Top Picks for the Best Gold IRA Companies

>>> Click here to learn more about Augusta Precious Metals <<<

#1 Augusta Precious Metals (Top Overall Choice)

Why Choose Augusta Precious Metals for Your Gold IRA?

Augusta Precious Metals is a leading gold IRA company known for investor education, transparency, and strong client support. With a 100% satisfaction guarantee, a top-tier buyback program, and up to 10 years of zero fees, Augusta ranks among the best gold IRA providers of 2025.

The company offers personalized web conferences to explain IRA options, helping investors understand gold IRA investing. It maintains an A+ BBB rating and a 4.8/5 TrustPilot score, reflecting high customer satisfaction.

Key Details

BBB Rating: A+

TrustPilot: 4.8/5

Minimum Investment: $50,000

Precious Metals Offered: Gold and silver

Pros

Strong focus on education and ethics

High client satisfaction

Transparent fee structure and no pressure sales

Industry-leading buyback policy

Educational materials on gold IRAs

Cons

Higher minimum investment

Limited selection beyond gold and silver

Phone-only transactions

Fee details not fully listed online

>>> Click here to learn more about American Hartford Gold <<<

#2 American Hartford Gold (Best for First-Time Precious Metals Investors)

Why Consider American Hartford Gold for Your Gold IRA?

American Hartford Gold is a family-owned precious metals company based in Los Angeles, offering gold and silver IRAs, as well as direct purchases of bullion. The company has delivered billions in physical gold and silver nationwide, making it a trusted name in the gold IRA industry.

Known for high customer satisfaction, American Hartford Gold holds an A+ BBB rating and a 4.8/5 TrustPilot score. It provides a price match guarantee, a strong buyback policy with no liquidation fees, and covers up to three years of storage, insurance, and maintenance fees for eligible accounts.

Key Details

BBB Rating: A+

TrustPilot: 4.8/5

Minimum Investment: $10,000 (IRA); $5,000 (cash purchases)

Precious Metals Offered: Gold, silver, platinum, palladium

Pros

High customer ratings and strong reputation

Free insured shipping on all orders

Buyback guarantee with no fees

Up to three years of free storage and maintenance

Price match on gold and silver offers

Cons

Limited fee transparency online

Smaller platinum and palladium inventory for IRAs

Minimum investment may be higher than some competitors

>>> Click here to learn more about Goldco <<<

#3 Goldco (Best for Customer Education and Support)

Why Goldco Is a Trusted Name for Gold IRAs

Goldco is a leading gold IRA company specializing in gold and silver IRAs since 2006. The firm helps investors roll over existing retirement accounts—such as traditional IRAs or 401(k)s—into self-directed IRAs backed by physical gold and other precious metals.

Known for strong customer satisfaction, Goldco maintains an A+ BBB rating and a 4.8/5 TrustPilot score. The company emphasizes investor education and personalized service, offering detailed resources and hands-on support throughout the setup process.

Goldco provides a competitive buyback program, free shipping and insurance, and promotional offers including up to 10% in free silver for qualifying accounts.

Key Details

BBB Rating: A+

TrustPilot: 4.8/5

Minimum Investment: $25,000 (IRA); $15,000 (direct purchase)

Precious Metals Offered: Gold, silver, platinum, palladium

Pros

High satisfaction and positive reviews

Comprehensive educational support

Competitive buyback program

Promotional gold and silver offers

Free insured shipping

Cons

Higher minimum investment compared to some competitors

Fee details require direct contact

Limited platinum and palladium options for IRAs

>>> Click here to learn more about Birch Gold <<<

#4 Birch Gold Group (Best for a Wide Range of Precious Metals Options)

Why Birch Gold Group Stands Out for Gold IRAs

Birch Gold Group is a well-established gold IRA company specializing in precious metal IRAs since 2003. The firm helps investors diversify retirement portfolios through self-directed IRAs backed by gold, silver, platinum, and palladium.

With an A+ BBB rating and strong client reviews, Birch Gold Group is recognized for its transparent service and focus on investor education. New clients receive a detailed “Precious Metals Guide” to support informed decisions on gold IRA investing.

The company offers a clear fee structure and a wide selection of gold and silver coins and bars suitable for IRAs.

Key Details

BBB Rating: A+

TrustPilot: 4.3/5

Minimum Investment: $10,000

Precious Metals Offered: Gold, silver, platinum, palladium

Pros

Broad selection of physical gold and other metals

Emphasis on investor education

Transparent fees with no hidden costs

High ratings across review platforms

Cons

Setup and storage fees may be higher than average

Longer delivery times reported by some clients

No online transactions; phone interaction required

>>> Click here to learn more about Lear Capital <<<

#5 Lear Capital (Best for Real-Time Market Tools and Data Access)

Why Lear Capital Could Be Right for Your Gold IRA

Lear Capital, established in 1997, is a veteran in the gold IRA industry, offering gold and silver IRAs along with direct purchases of bullion and rare coins. The company focuses on customer education, real-time pricing, and transparent service.

Known for its A+ BBB rating and 4.8/5 TrustPilot score, Lear Capital provides personalized support through dedicated account representatives and offers a 24-hour risk-free purchase guarantee. A no-fee buyback program enhances value for investors managing gold IRA accounts or other retirement investments.

Key Details

BBB Rating: A+

TrustPilot: 4.8/5

Minimum Investment: $10,000

Precious Metals Offered: Gold, silver, platinum, palladium

Pros

Extensive educational materials on gold IRA investing

Transparent pricing with live updates

Personalized account support

Risk-free purchase window

Buyback program with no fees

Cons

Setup and storage fees may be higher than some alternatives

Delivery delays reported by some clients

Phone-only transactions; no online order processing

How to Choose from the Best Gold IRA Companies

This guide simplifies the gold IRA investment process by highlighting reputable providers based on transparency, reliability, and customer trust. An initial list of 18 companies was narrowed to those with at least an A+ BBB rating and 4.5+ on TrustPilot.

Evaluation Criteria

Reputation: Proven track record and educational support

Fees: Transparent pricing and disclosures

Customer Experience: Usability, responsiveness, and support quality

Compliance: Adherence to IRA regulations

Feedback: Verified consumer reviews across platforms

Companies with lower ratings were excluded. The final list reflects firms with clear fee structures, reasonable minimum investments, and strong overall performance. Rankings are reviewed regularly to maintain accuracy and relevance.

FAQs

Who ranks as the top gold IRA company?

The best gold IRA company varies based on individual needs such as investment goals, budget, and storage preferences. Top-rated providers like Augusta Precious Metals, Goldco, and Birch Gold Group are known for transparency, service quality, and customer satisfaction. Comparing annual fees, gold IRA account features, and verified consumer reviews is essential before making a decision.

Are gold IRAs a smart investment?

Gold IRAs can offer portfolio diversification and act as a hedge against inflation and currency risk. They are often chosen for stability during market downturns. However, they involve annual fees and may yield lower long-term returns than traditional investments. Suitability depends on your financial strategy, investment timeline, and risk profile.

What's the best approach to buying gold through an IRA?

To invest in a gold IRA:

Open a self-directed IRA with an approved custodian

Fund the account via rollover or transfer from an existing retirement plan

Choose a reputable gold IRA provider

Purchase IRS-approved gold coins or bars

Store assets in an IRS-approved depository

Monitor and adjust your holdings over time

Working with a gold IRA specialist and financial advisor helps ensure IRS compliance and alignment with retirement goals.

Can a gold IRA generate profit?

A gold IRA may yield profit if gold prices increase after purchase. It provides long-term diversification and inflation protection, but returns vary. Costs like storage fees and custodian charges can impact performance. As with any IRA investment, research and professional guidance are key to managing risk and setting realistic expectations.

Final Thoughts

In reviewing the top gold IRA companies of 2025, one fact remains clear: gold remains a reliable asset for retirement planning. The right gold IRA provider can combine the enduring value of physical gold with strategic investment options tailored to long-term goals.

>>> Click here to learn more about Augusta Precious Metals <<<

This guide has outlined leading firms in the gold IRA industry, each offering distinct advantages in terms of transparency, service, and product selection. Choosing a provider should align with your retirement objectives, investment preferences, and comfort with fees and custodial support.

With careful research and a defined strategy, investing in a gold IRA can support financial ++

+stability and portfolio diversification—helping preserve value in uncertain times.