Gold IRA Tax Rules

The owners of this website may receive compensation for recommending certain precious metals companies. As a result, the content on this site, including positive and other reviews, may not be entirely neutral or independent.

Click here to request your free gold IRA guide from Augusta Precious Metals

Quick Summary

For 2025, individuals under age 50 can contribute up to $7,000 annually to a Gold IRA, while those 50 and older can contribute up to $8,000, which includes a $1,000 catch-up contribution. These limits apply across all IRA accounts held by the individual.

Withdrawals from a traditional Gold IRA are taxed as ordinary income. Qualified withdrawals from a Roth Gold IRA are tax-free if the account has been open for at least five years and the account holder is over age 59½.

Gold IRA holders must begin taking required minimum distributions (RMDs) at age 73, with substantial penalties for non-compliance. Roth Gold IRAs are exempt from RMDs during the original owner’s lifetime.

Early withdrawals from a Gold IRA—before reaching age 59½—typically trigger a 10% penalty plus applicable income taxes, unless an exception applies.

In 2025, individuals under 50 can contribute up to $7,000 annually to a Gold IRA; those 50 and older can contribute $8,000, including a $1,000 catch-up. These limits apply across all IRAs.

Traditional Gold IRA withdrawals are taxed as income, while qualified Roth Gold IRA withdrawals are tax-free if the account is over five years old and the holder is 59½ or older. RMDs begin at age 73 for traditional accounts, but Roth IRAs are exempt during the owner's lifetime.

Early withdrawals before 59½ usually incur a 10% penalty plus taxes, unless exceptions apply.

Defining a Gold IRA: What You Need to Know

Unlike traditional IRAs that invest in stocks and paper-based assets, a Gold IRA allows you to use retirement savings to purchase physical gold. This offers a tangible way to preserve wealth and secure your financial future, especially once you reach retirement age.

Levon Galstyan, CPA and Accounting Consultant at Oak View Law Group, explains that Gold IRAs enhance portfolio diversification and serve as a hedge against inflation. He views them as a smart choice in today’s unpredictable economic climate, offering key advantages such as:

Protection from market volatility

Inflation resistance through tangible assets

Potential income generation during retirement

Setting up a Gold IRA is a simple process that starts with selecting a reputable custodian. The custodian will establish the account and manage your investments in accordance with IRS rules. Once your account is open, you can begin adding physical gold to your retirement portfolio.

However, not all metals are eligible. The IRS only allows certain precious metals that meet specific purity standards, including:

Gold: Minimum 99.5% purity

Silver: Minimum 99.9% purity

Platinum: Minimum 99.95% purity

Palladium: Minimum 99.95% purity

Choosing IRS-approved metals ensures your Gold IRA remains compliant and preserves its tax-advantaged status.

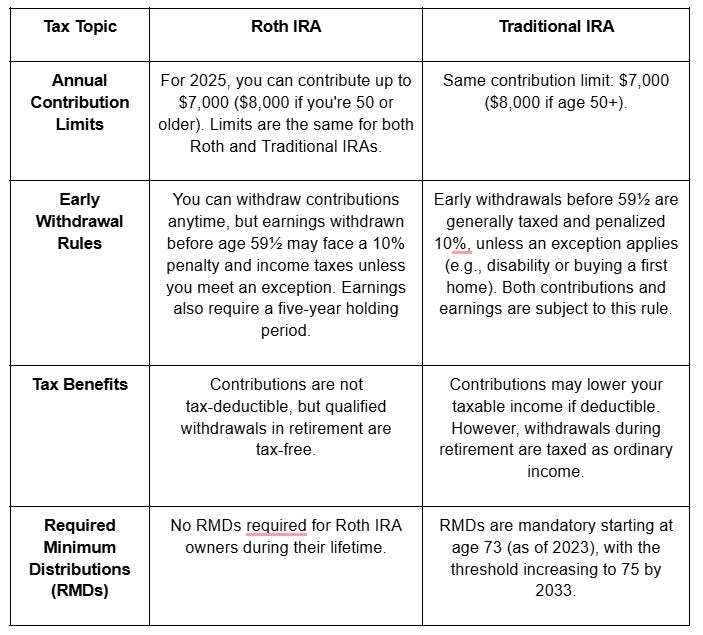

How Taxation Works for IRAs

Taxation rules for precious metals IRAs depend on the type of account you choose: Traditional or Roth. Each has distinct tax advantages and implications for how your gold or other metals are treated over time. The key differences between them are outlined in the table below for easy comparison.

Note: Gold IRAs are available in two primary forms—Traditional and Roth. Understanding the tax implications of each is essential to choosing the option that best aligns with your financial goals and investment strategy.

Making Contributions to Your Gold IRA

A key aspect of Gold IRA taxation is the contribution limit, which varies by IRA type. In 2025, the maximum contribution is $7,000, or $8,000 if you're 50 or older (including a $1,000 catch-up). These limits apply to both Traditional and Roth IRAs combined.

Roth IRAs allow contributions at any age, while Traditional IRAs require that you or your spouse have taxable income. To make catch-up contributions to a Traditional IRA, you must be 50 or older by year-end.

Contribution Limits Based on Income

Roth IRAs have income limits that may reduce or block your ability to contribute, depending on your salary. You can contribute up to the annual cap or your total earned income—whichever is lower. Earned income includes wages, alimony, and self-employment earnings.

For example, if the cap is $6,000 but you earn only $5,000, your maximum contribution is $5,000. If you earn $6,001 or more, you can contribute the full $6,000.

Withdrawing Funds: How Gold IRA Distributions Are Taxed

IRS rules require you to start taking required minimum distributions (RMDs) from your IRA by April 1 following the year you turn 72 (or 70½ if before 2020), with annual withdrawals due by December 31. Gold or fund withdrawals at retirement age are taxed accordingly.

Withdrawing before age 59½ typically incurs a 10% penalty, unless certain exceptions apply, such as:

Unreimbursed medical expenses

Health insurance during unemployment

Permanent disability

Higher education costs

First-time home purchase or rebuild

Inherited IRA

IRS levy satisfaction

Active military duty

Substantially equal periodic payments for 5+ years or until age 59½

Key Tax Advantages of Investing in a Gold IRA

Did you know gold IRAs are popular not just for asset security, but also for their tax advantages? These accounts offer key tax benefits that can strengthen your long-term retirement strategy. Here’s a closer look at the main advantages.

How Capital Gains Are Treated in a Gold IRA

Gold IRAs offer favorable capital gains tax treatment. While direct gold sales are taxed at a 28% rate, gains within a Traditional IRA are taxed as ordinary income upon withdrawal—often resulting in a lower effective tax rate than selling gold outside an IRA.

Benefits of Tax-Deferred Growth

A gold IRA provides tax-deferred growth, allowing your investments to grow without annual taxes on income or gains. This uninterrupted compounding can boost long-term returns. Withdrawals in retirement are taxed as ordinary income, which may be at a lower rate—offering additional tax savings.

Potential Tax Perks for Inheriting a Gold IRA

A notable benefit of a Gold IRA is its ability to be passed on to heirs. While IRA inheritance rules can be complex, a unique advantage is that beneficiaries may hold physical precious metals in an Inherited IRA. They can also convert inherited assets into IRS-approved metals like gold, silver, platinum, and palladium. Below are key inheritance guidelines to keep in mind.

Rules for Eligible Designated Beneficiaries

You are considered an eligible designated beneficiary if you are:

A surviving spouse

Chronically ill

Permanently disabled

A minor child

Less than 10 years younger than the original IRA owner

If you meet any of these criteria, you generally have two options:

Option 1: Transfer the assets into an Inherited IRA in your name and take Required Minimum Distributions (RMDs) based on either your own life expectancy or the original owner's.

Option 2: Use the 10-year rule—transfer the assets into an Inherited IRA and fully distribute the account by December 31 of the 10th year after the original owner's death.

Note: These options may vary depending on whether the original IRA holder had reached age 72 (RMD age) at the time of death.

Understanding Designated Beneficiary Guidelines

If you don’t qualify as an eligible designated beneficiary, you fall under the designated beneficiary category. In this case, the rules are more restrictive:

You must fully withdraw and liquidate the account by December 31 of the year following the original IRA owner’s death.

Understanding your status and following the correct timeline is crucial to avoid tax penalties and maximize the inheritance benefits of a Gold IRA.

Common Gold IRA Tax Mistakes and How to Avoid Them

While gold IRAs offer attractive tax advantages, they also come with potential pitfalls that investors should be aware of. Fortunately, most of these issues can be avoided with careful planning and a clear understanding of the rules. Let’s take a closer look at some common mistakes and how to steer clear of them.

Activities That Qualify as Prohibited Transactions

One major pitfall to avoid is self-dealing, where the IRA owner—or a disqualified person like a family member or affiliated business—personally benefits from IRA assets.

For example, using gold from your IRA for personal use is a prohibited transaction. All gold held in an IRA must remain in an IRS-approved depository until you are eligible for distribution.

Violations can result in a 15% penalty on the transaction amount, and if not corrected, an additional 100% penalty may apply. Staying compliant is key to protecting your investment.

Why Taking Physical Possession of Gold Can Be Risky

Physically taking possession of gold from your Gold IRA is considered a taxable distribution. If you seek possession before reaching retirement age, you’ll owe income taxes on the value of the gold at your current tax rate. Additionally, early withdrawals are subject to an extra 10% penalty, compounding the financial risk if done prematurely.

Penalties You Could Face for Non-Compliance

Tax penalties extend beyond early withdrawal fees. Once you reach age 73, you are required to take Required Minimum Distributions (RMDs) from your gold IRA. Failing to do so results in a hefty penalty—50% of the amount you were supposed to withdraw.

Fortunately, the IRS may waive this penalty if you can demonstrate that the shortfall was due to a reasonable error and that you are taking corrective action. However, understanding and complying with RMD rules is crucial to avoid costly consequences.

Proper IRS Reporting for Your Gold IRA

To get the most from your gold IRA, it's important to avoid penalties and follow IRS reporting rules carefully. Here are the key points:

Forms to use: Report distributions on IRS Form 1099-R and file your annual return with Form 1040. If you incur early withdrawal penalties, use Form 5329.

Deadlines: Keep track of tax deadlines—for example, 2022 IRA contributions were due by April 18, 2023. Timely filing helps avoid penalties.

Consult a tax advisor: A qualified tax professional can ensure you're using the right forms, meeting deadlines, and maximizing your tax benefits while staying up to date with changing IRS rules.

Final Thoughts

A gold IRA offers valuable retirement benefits, but also comes with specific rules on contributions, withdrawals, and taxes. To avoid costly penalties and get the most from your investment, it's important to understand how gold IRA taxation works. With the right knowledge and planning, you can confidently maximize the advantages of your gold IRA.

Click here to request your free gold IRA guide from Augusta Precious Metals