Is Silver Worth More Than Gold

At a Glance

Gold commands a much higher price than silver, trading at nearly 100 times the price per ounce as of 2025.

Silver's widespread industrial applications—from electronics to solar panels—support its value and hint at strong future growth potential.

Silver tends to be more volatile than gold, experiencing greater price fluctuations and offering higher risk along with the potential for greater returns.

Gold is often viewed as a safe-haven asset, while silver’s dual role as both an investment and industrial metal may present distinct long-term opportunities.

For centuries, precious metals have been trusted tools for preserving wealth—and they still play a vital role today as a hedge against inflation and economic uncertainty. Among these, gold and silver remain the top picks for investors.

Both metals are valued for their enduring appeal, but they serve very different purposes in the market. That raises a common question: Is silver actually more valuable than gold?

At first glance, the answer is simple—no, at least not by price. Gold typically trades at nearly 100 times the price of silver per ounce. But dig a little deeper, especially when considering silver’s expanding use in industrial applications, and the comparison gets a lot more interesting.

Let’s take a closer look.

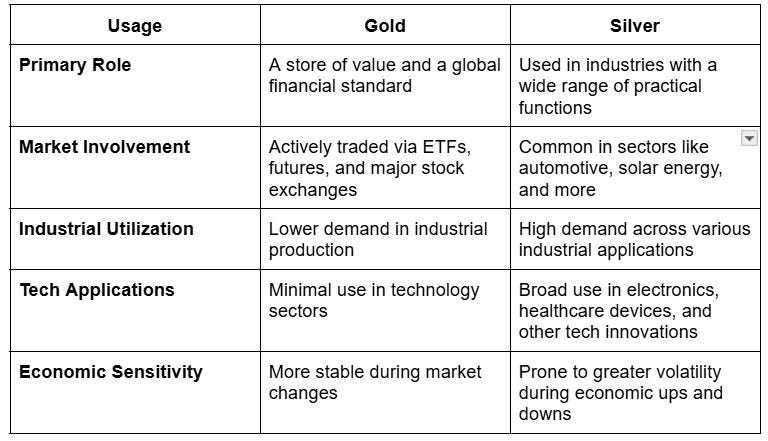

Gold vs. Silver: Core Differences

Visually, gold and silver each bring something unique to the table. Silver is sleek, bright, and modern, while gold exudes a classic, enduring elegance with its rich yellow hue. But in terms of market value, gold has long reigned supreme—and with good reason.

Gold is prized mainly as a financial asset. It tends to shine in times of economic stress, gaining value during inflation, currency devaluation, or market uncertainty.

Silver, by contrast, plays a dual role. It’s both a store of value and a critical industrial metal, used in everything from electronics and batteries to solar panels and medical equipment.

This split identity makes silver more volatile—but also positions it for potentially greater upside, especially as demand grows in tech and renewable energy industries.

A Historical Perspective

Silver hasn’t always taken a back seat to gold. In fact, there was a time when silver was considered even more precious.

Ancient Egypt: Silver was rarer than gold and sometimes regarded as the more prestigious metal.

Before the 20th Century: Across many civilizations, both silver and gold were central to trade, religious artifacts, and wealth storage—each playing a vital role in early economies.

But by 1925, the divide started to show. Gold was priced at $20.64 per ounce, while silver lagged far behind at just $0.69. The gap only widened after the U.S. abandoned the gold standard in 1971—a shift that sparked a surge in both metals as investors sought refuge from fiat currency.

In the 1980s, both metals hit historic highs: gold reached $677 per ounce, and silver climbed above $36. Silver’s price, however, was far more volatile. For some investors, that unpredictability has become part of its appeal—offering the potential for bigger, faster returns.

2025 Market Trends: What’s Influencing Gold and Silver Prices?

Gold reached a major milestone in late October 2024, hitting an all-time high of $2,778 per ounce. This rally didn’t happen in a vacuum—it was driven by a mix of powerful forces: expectations of Federal Reserve rate cuts, a weakening U.S. dollar, persistent geopolitical tensions, and ongoing central bank gold purchases. Together, these factors sparked a surge in demand and pushed gold to new heights.

Silver, on the other hand, has taken a more volatile route. Its price has been bouncing between $28 and $32 per ounce—less dramatic than gold’s rise, but still trending upward. And from a broader perspective, silver’s movement reflects a few fundamental drivers:

Supply and Demand: Like all commodities, silver’s price responds to shifts in availability and use. When industrial demand rises—especially in tech and clean energy—or when investors seek safe-haven assets, prices climb. Oversupply, however, can weigh prices down. Silver’s dual role as both an industrial and investment metal makes this dynamic especially relevant.

Central Bank Reserves: Gold remains a cornerstone of central bank reserves worldwide. As these institutions diversify away from fiat currencies—particularly in times of inflation or dollar weakness—they tend to boost their gold holdings, putting upward pressure on prices.

U.S. Dollar Strength: Gold typically moves inversely to the dollar. When the dollar softens due to inflation fears, shifting interest rates, or economic uncertainty, gold becomes more appealing as a store of value.

Geopolitical and Economic Uncertainty: Precious metals often shine during times of global instability. Recently, concerns over potential tariffs and trade tensions under a renewed Trump agenda have unsettled markets, driving investors toward gold and silver as a hedge against volatility.

Industrial & Tech Applications: Silver’s Advantage

Although both metals have industrial uses, silver truly stands out when it comes to real-world utility and modern technological relevance.

Gold: Niche Yet Vital Uses

Gold does have industrial applications, but they’re relatively limited compared to silver. Its primary roles are in specialized fields like electronics, aerospace, and dentistry, where its resistance to corrosion and excellent conductivity are essential. However, these uses represent a small fraction of gold's overall demand—most of its value is still driven by investment, jewelry, and central bank reserves.

Silver: A Key Player in Industry

Silver’s utility extends far beyond its role as an investment metal. It plays a critical part in:

Electronics (smartphones, computers, televisions)

Automotive components

Medical devices

Water purification systems

Solar panels and renewable energy technologies

Thanks to its unmatched electrical conductivity and natural antibacterial properties, silver is a foundational material in clean energy and advanced manufacturing. Photovoltaic cells in solar panels, for instance, rely heavily on silver, and as the global transition to green energy accelerates, demand for silver is expected to follow suit.

Unlike gold, silver's price is significantly influenced by industrial and technological trends—not just by market sentiment—making it a more dynamic asset in today’s developing economy.

Let me know if you'd like help with the comparison table next:

Investing and Public Perception

In recent years, both gold and silver have remained top picks among individual investors, institutions, and central banks. Gold still holds its reputation as the ultimate “safe haven” during times of market uncertainty—but silver is steadily gaining ground, thanks to its unique blend of investment appeal and industrial utility.

So, what’s driving this renewed interest in silver?

There’s growing awareness that silver isn’t just a precious metal—it’s also essential to rapidly growing sectors like clean energy, advanced electronics, and electric vehicles. As these industries scale, silver’s importance—and price potential—are becoming harder to overlook.

A 2023 report from Oxford Economics, commissioned by the Silver Institute, projects that global silver demand will rise 46% by 2033, nearly twice the growth rate of the previous decade. A major portion of this demand is expected to come from solar power, EV batteries, and 5G technologies, all of which rely on silver’s conductivity and durability.

Traditional segments like jewelry and silverware, which saw declines during the 2023 economic slowdown, are also projected to rebound—growing 34% and 30% respectively by 2033. Together, these categories currently make up about 60% of overall silver demand, a share that’s expected to rise even further.

Looking ahead, the 2025 market outlook for silver is increasingly bullish. With expanding industrial applications and rising green energy investments, many analysts anticipate a continued recovery in silver prices—especially as economic uncertainty drives investors toward alternative assets.

While gold will likely remain a cornerstone in most portfolios, silver’s affordability and close ties to emerging technologies make it a compelling option for those seeking diversification within the precious metals space.

Final Thoughts

Gold will likely always hold its status as a reliable store of value. But for investors seeking greater growth potential in today’s dynamic landscape, silver may offer the more compelling opportunity in 2025.

Its lower price point means you can own more ounces per dollar, giving you added flexibility and the potential for outsized returns—especially as demand from industrial sectors like clean energy and electronics continues to rise. However, silver’s upside comes with more volatility and less liquidity than gold. Its price is often more sensitive to shifts in technology, global manufacturing, and economic cycles.

So, is silver worth more than gold? Not by price—but possibly by potential. In terms of market relevance and growth prospects this year, silver is definitely in the spotlight.

Ultimately, it comes down to your investment goals. If long-term stability and wealth preservation are your priorities, gold remains a trusted choice. But if you’re looking to diversify, tap into emerging industries, and position yourself for future gains, silver deserves a serious place in your portfolio.