This website’s owners may receive compensation for recommending certain precious metals companies. As a result, the content—including positive reviews and other commentary—may not be unbiased or independent.

In-Depth Expert Analysis

The days of limited precious metals investment options are long gone—especially with reputable companies like Noble Gold now in the picture. You might wonder why I consider Noble Gold a trusted partner amid a crowded and competitive market. Drawing from decades of experience in the industry, I’ve found that Noble Gold consistently stands out for its reliability, strong values, and comprehensive range of investor-focused services, making it a top choice for many U.S. citizens.

Founded on the principle of delivering real value to clients and their financial future, Noble Gold Investments offers a wide variety of precious metals options, tailored survival packs, secure storage solutions, and low minimum investment requirements.

But is Noble Gold the right fit for your investment goals? Let’s examine what the company offers in this in-depth review.

>>> Click here to learn more about Noble Gold Reviews 2025 <<<

Noble Gold: Quick Company Snapshot

With over 20 years of experience in gold investments, Noble Gold is committed to helping clients grow and protect their wealth. Under the leadership of CEO Collin Plume, the company’s knowledgeable team focuses on client education and transparency—clearly outlining both the potential benefits and risks of investing in precious metals.

As a trusted precious metals dealer, Noble Gold offers a broad selection of bullion products, including collectible gold and silver coins. Beyond one-time purchases, investors can also open Gold and Silver IRA accounts, providing long-term retirement solutions backed by physical assets.

Noble Gold’s credibility is further enhanced by its partnership with Equity Trust, a respected IRA custodian in the industry. The company also works with International Depository Services to offer secure storage options in Texas, Delaware, and Mississauga.

But there’s even more that sets Noble Gold apart as a dependable partner in the precious metals space.

Let’s take a closer look at how the company has maintained its strong reputation over the years.

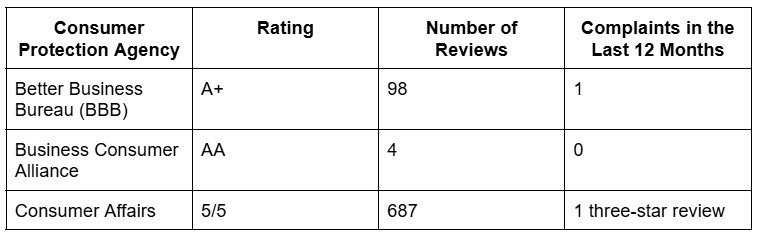

How Noble Gold Scores on Consumer Review Platforms

Why Noble Gold Shines Among Competitors

Over the years as a precious metals investor, I’ve come across only a handful of companies that genuinely strive for excellence—and actually deliver on it. Noble Gold is one of those rare names that truly stands out in this competitive industry. Backed by thorough research and my own hands-on experience, here are the key features that make Noble Gold a standout choice.

Buying Precious Metals

Noble Gold makes it easy to start investing in precious metals, requiring a minimum investment of just $5,000—one of the lowest entry points in the market. Even with a modest budget, you can begin building your portfolio with a range of high-quality products, including:

Gold bullion

Silver bars and coins

Platinum bars and coins

Palladium bars and coins

Rare and collectible items like Baird & Co Platinum Bars and Morgan Silver Dollars

This accessibility makes Noble Gold an excellent choice for both new and seasoned investors.

Royal Survival Pack Options

For those looking to prepare for uncertain times, Noble Gold offers Royal Survival Packs—carefully curated collections of gold and silver designed to safeguard your wealth during financial instability. These packs are particularly attractive to survivalists and those who value having tangible assets in the event that traditional banking systems or foreign currencies fail.

With investment options ranging from $5,000 to $500,000, there’s a survival pack for almost any budget. While IRAs aren’t eligible for these packs, gold and silver coins are popular inclusions due to their liquidity and ease of use in real-world scenarios. Orders are shipped directly to your home within five days, or stored securely at Noble Gold’s private depositories.

Also, the Noble Ambassador Survival Pack is available for international investors who want to keep precious metals stored in North America. Although the company doesn’t offer storage or investment services outside the U.S., this unique pack—purchasable with dollars or Bitcoin—provides a viable option for offshore clients.

Setting Up a Precious Metals IRA

Noble Gold offers investors the ability to open Gold and Silver IRAs, providing a tax-advantaged way to protect and grow wealth over the long term. While you won’t have physical access to the metals in your IRA, your assets are securely stored and available for withdrawal when you reach retirement age or meet qualifying conditions.

The process is straightforward and guided by professionals who prioritize clarity and transparency every step of the way.

Secure Storage Facilities

One of Noble Gold’s standout features is its secure storage partnerships. Through its collaboration with International Depository Services, the company offers high-security vaults for your IRA investments.

Noble Gold is also unique in being the only provider in the industry that stores gold in Texas—a state that currently lacks a state-operated gold depository. Beyond Texas, clients can choose to store their assets in top-tier, insured facilities in Delaware (USA) or Mississauga, Ontario (Canada).

Hassle-Free Buyback Program

Another major advantage is Noble Gold’s buyback program, which is available even to international clients. This means you can liquidate your holdings purchased through Noble Gold from virtually anywhere in the world—an offering not many companies provide.

In an industry where selling your precious metals back can be complicated or limited, Noble Gold’s straightforward and accessible buyback service adds real peace of mind.

Learning Center and Educational Tools

Beyond products and services, Noble Gold stands out for its commitment to investor education. As someone who remembers how overwhelming this space can feel in the beginning, I appreciate how much support Noble Gold provides to help clients make informed decisions.

Their website features a robust “Learn” section with valuable resources like:

A free gold and silver investment guide

Precious Metals 101 and Investment Basics

In-depth insights into Gold IRAs

A comprehensive educational library

You’ll also find a regularly updated news section covering financial trends, market movements, and timely investment topics—making Noble Gold a reliable resource whether you’re just starting or looking to expand your knowledge.

Understanding Noble Gold’s Fee Structure

When it comes to fees for precious metals investments, it’s always wise to choose companies that are upfront about their charges and avoid piling on hidden costs. While Noble Gold is known for its customer service and transparency, their website doesn’t list all the specifics related to fees.

That said, through my own research, I uncovered details about their annual storage fees for Gold and Silver IRA accounts. Here’s a breakdown:

Gold IRA:

$80 annual fee (standard)

$150 annually for storage in Texas or Delaware

Silver IRA:

$225 annual fee (standard)

$250 annually for storage in Texas

These fees cover secure, segregated storage, full insurance, and 24/7 online access so you can monitor your assets in real time. While the lack of fee transparency on the website could be improved, the pricing itself is competitive when compared to industry standards.

Is Noble Gold a Company You Can Trust?

Now that we’ve learned everything Noble Gold brings to the table, it’s clear why the company has built such a strong reputation online. With a diverse range of investment options, a commitment to client education, and responsive customer support, it’s no surprise that satisfied investors consistently leave positive reviews.

Even public figures like TV personality Charlie Kirk have publicly endorsed Noble Gold as a reliable choice for precious metals investing—a testament to the trust the company has earned.

Noble Gold also holds an A+ rating from the Better Business Bureau, further reinforcing its credibility and focus on customer satisfaction.

That said, a few customers on platforms like Trustpilot have expressed concerns, particularly regarding the lack of clarity around fees. While transparency could certainly be improved in this area, these complaints are relatively few compared to the overwhelming number of positive experiences reported by investors.

It’s worth remembering that no company is completely free of issues or critical feedback. What matters most is how a business responds—and Noble Gold has shown a consistent ability to address concerns while maintaining a high standard of service over time.

The Upsides and Downsides

Advantages

Offers a wide range of educational resources tailored for both beginners and experienced investors

Provides the option for physical possession of precious metals

The only company offering precious metals IRA storage in Texas, meeting top-tier security standards

Features one of the lowest minimum investment requirements in the industry

Gives access to a broad selection of investment-grade metals, including gold, silver, platinum, and palladium bars and coins

Offers a convenient buyback program, allowing customers to easily liquidate their holdings

Delivers Royal Survival Packs directly to your doorstep for added convenience

Website includes multiple ways to get expert guidance and professional support

Disadvantages

Investment and storage services are limited to the U.S. and Canada; the Noble Ambassador Survival Pack is also restricted to North American residents

Coin pricing details are not listed on the website, requiring direct contact for current rates.

Final Thoughts

Noble Gold stands out as a reputable and reliable player in the highly competitive precious metals market. From my extensive experience in this industry, it’s one of the few companies that combines a broad range of investment options with low entry requirements—making it accessible to a wide range of investors.

That said, it’s important to evaluate whether Noble Gold aligns with your personal investment goals. Take time to review what the company offers in relation to your specific needs. If you're still seeking alternatives, feel free to check out my guide to the best precious metals companies for a broader comparison.

I hope this in-depth review has given you the clarity and insight needed to make confident, informed decisions about your precious metals investments.

>>> Click here to learn more about Noble Gold Reviews 2025 <<<

FAQs

What’s the Minimum Investment Requirement at Noble Gold?

Noble Gold requires a minimum investment of $5,000, making it an accessible option for beginners looking to enter the precious metals market.

How Safe Is the Noble Gold Depository?

Noble Gold’s storage solutions are highly secure. Through its partnership with International Depository Services (IDS), the company offers access to facilities approved by COMEX/CME, LBMA, and ICE—some of the most trusted standards in the industry. This ensures your precious metals are stored in world-class, fully insured vaults.

Does Noble Gold Offer International Shipping?

Noble Gold does not currently offer international shipping. However, international clients can still purchase and store their precious metals in Noble Gold’s secure vaults located in the U.S. and Canada. The Noble Ambassador Survival Pack is designed specifically for offshore investors who want to keep their assets in North America. Additionally, Noble Gold’s Buyback Program allows clients around the world to safely liquidate their holdings when needed.