Top Rated Gold IRA Companies

Gold IRAs offer tax-advantaged access to physical precious metals, helping diversify portfolios and hedge against inflation. Unlike paper assets, gold provides stability and reduces volatility. While not all providers offer equal value, five standout companies lead the space in 2025.

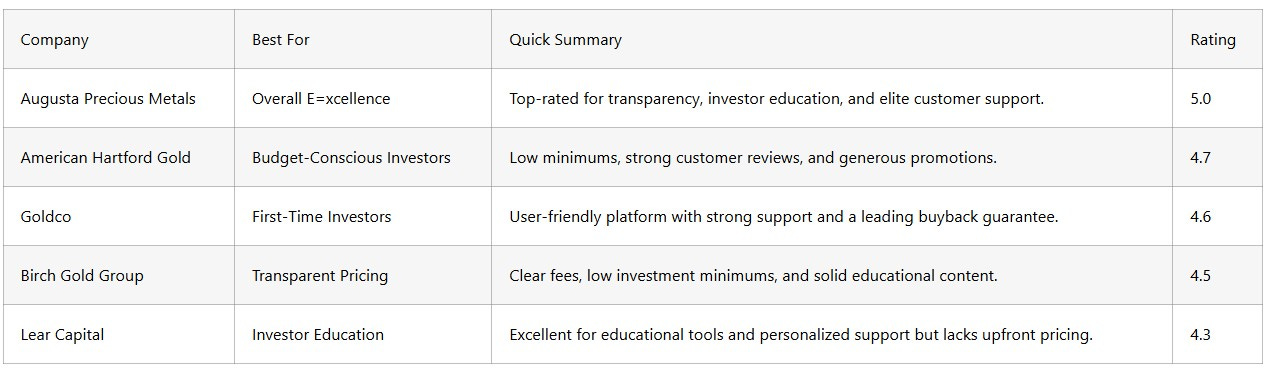

At a Glance

Best Gold IRA Companies this 2025

Each of the firms listed below brings something unique to the table, whether you're just getting started with precious metals or have years of investing experience.

Top Gold IRA Companies: In-Depth Reviews

>>> Click here to learn more about Augusta Precious Metals <<<

#1. Augusta Precious Metals: Best Gold IRa Company Overall

Expert Insight

Augusta Precious Metals is a top gold IRA provider known for transparency, reliable support, and high customer satisfaction. With an A+ BBB rating and a streamlined setup process, it stands out for investor education and personalized guidance—making it a trusted choice for both new and experienced gold investors.

Services Provided

Whether you're rolling over an existing IRA or making a direct purchase, Augusta offers a range of precious metals solutions tailored to individual goals:

Gold and silver bullion

IRA-eligible coins

Pre-rolled gold coins

Customized investment packages based on your financial objectives

Advantages

Strong emphasis on client education and empowerment

Real-time pricing charts available on their website

Free web conferences with a Harvard-trained economic analyst

Ongoing market news and expert video insights

Educational resources focused on avoiding Gold IRA scams

Professional support with paperwork, rollovers, and account setup for a seamless experience

Drawbacks

A minimum investment of $50,000 is required

Only one depository location is available for international investors (Canada)

>>> Click here to learn more about Augusta Precious Metals <<<

>>> Click here to learn more about American Hartford Gold <<<

#2. American Hartford Gold: Ideal for Budget-Conscious Investors

Expert Insight

American Hartford Gold is a trusted Gold IRA provider with over a decade of experience and top ratings across BBB, Google, and TrustPilot. Partnering with Equity Trust, the company ensures secure account management and offers clear rollover support, along with a market-value buyback program. Reviews highlight AHG’s transparency, flexibility, and strong customer service.

Services by American Hartford Gold

American Hartford Gold offers a wide selection of IRA-approved gold and silver products suitable for long-term investment strategies.

The inventory includes American Gold Eagles and Gold Buffalo coins.

Investors can also choose American Silver Eagles and Canadian Maple Leafs.

1-ounce gold bars are available for those seeking larger tangible assets.

The product range supports goals like inflation protection and portfolio diversification.

Advantages

Strong reputation for customer service and reliability

Free silver promotion valued up to $15,000 for qualifying investors

No maintenance fees for up to three years

24/7 customer support

Low IRA minimum investment of just $10,000

Straightforward, no-fee buyback process

Price match policy to ensure competitive metal pricing

Drawbacks

Precious metal pricing is not displayed directly on their website

>>> Click here to learn more about American Hartford Gold <<<

>>> Click here to learn more about Goldco <<<

#3. Goldco: Great for First-Time Investors

Expert Insight

Goldco is a reputable Gold IRA provider known for clarity, personalized service, and a user-friendly platform. Backed by an A+ BBB rating, it remains a reliable choice for long-term gold investors seeking trusted, client-focused support.

Services Provided

Goldco provides a comprehensive range of services tailored to both new and experienced investors.

401(k) and IRA rollovers are handled step-by-step to ensure smooth, compliant transfers.

A wide selection of gold and silver coins and bullion is available for retirement accounts and direct purchase.

The buyback program offers competitive market rates for selling metals back to Goldco.

Advantages

Specializes in top-tier Gold IRA investment services

No minimum investment requirement

Thousands of 5-star reviews and high client satisfaction

Wide selection of certified gold bars and coins

Bonus silver offered for qualifying accounts

One of the strongest buyback guarantees in the industry

Website includes updated articles and market news

Responsive and knowledgeable customer support team

Drawbacks

The company doesn’t publicly list its pricing, storage details, or custodian partnerships

>>> Click here to learn more about Goldco <<<

>>> Click here to learn more about Birch Gold <<<

#4. Birch Gold Group: Top Pick for Transparent Pricing

Expert Insight

Birch Gold Group is a trusted Gold IRA provider known for hands-on service, transparency, and educational support. Offering a wide range of IRA options and earning an A+ BBB rating, it serves both new and experienced investors with consistently strong client reviews.

Services Provided

Birch Gold provides a wide selection of investment-grade precious metals for portfolio diversification.

Available products include gold, silver, platinum, and palladium coins and bars.

Investors can choose between adding metals to a gold IRA or making direct purchases.

The broad inventory supports customized strategies for building tangible asset portfolios.

Advantages

Website offers educational resources tailored for both beginners and experienced investors

Hundreds of excellent client testimonials over the years

One of the lowest gold IRA investment minimums in the industry

Transparent fee structure clearly outlined on their website

Real-time gold pricing updates available online

Buyback services for investors looking to sell metals held within their IRA

Drawbacks

Investments cannot be made directly through the website—you must speak with a representative to get started

The amount of information on the site, while useful, can be overwhelming at first glance

>>> Click here to learn more about Birch Gold <<<

>>> Click here to learn more about Lear Capital <<<

#5. Lear Capital: Best for Investor Education

Expert Insight

Lear Capital brings over 20 years of experience and a client-focused approach to gold IRAs. Known for transparency and personalized guidance, the company holds an A+ BBB rating and remains a reliable choice for straightforward, education-driven precious metals investing.

Services Provided

Lear Capital offers a broad selection of IRA-approved precious metals for portfolio diversification.

Gold and silver bullion options are available.

Investors can choose American Gold Eagles, Silver Eagles, and Canadian Maple Leafs.

Gold and silver bars come in various weights.

The company supports IRA rollovers and transfers from 401(k) and traditional IRAs.

Advantages

Over 25 years of experience in the gold and precious metals industry

Personalized account setup and rollover support

Strong customer satisfaction ratings and verified reviews

Competitive pricing and a price match guarantee

Free investor kits and educational materials for beginners

Online tools for real-time account tracking

24-hour risk-free transaction policy adds flexibility and peace of mind

Drawbacks

Pricing and fee details are not as transparent upfront—you’ll need to speak with a representative to get the full breakdown

Limited investment options for those outside the United States

Understanding Gold IRAs

A Gold IRA is a self-directed retirement account that holds physical gold and other precious metals instead of paper assets. It follows standard IRA rules but adds a stable, inflation-resistant asset to the portfolio. Traditional IRAs offer tax-deductible contributions, while Roth IRAs allow tax-free withdrawals. Gold IRAs can also include ETFs, mutual funds, or mining stocks for added diversification.

Benefits of Gold Investments

Gold remains a valuable addition to a well-balanced retirement portfolio.

It offers diversification, often moving independently of stock markets.

As an inflation hedge, gold helps preserve purchasing power over time.

Its stability makes it resistant to sharp market downturns.

Physical ownership provides security and long-term value in volatile conditions.

>>> Click here to learn more about Lear Capital <<<

Key Factors When Choosing a Gold IRA Provider

Choosing the right gold IRA company is crucial to long-term success. Not all providers in the gold IRA industry offer the same level of trust, service, or value.

Trust and Reviews

Reputable gold IRA companies hold high ratings from the BBB, BCA, and TrustPilot. Consistent positive feedback signals reliability in the gold IRA industry, while unresolved complaints are red flags for investors looking to invest in a gold IRA.

Secure Storage

Top gold IRA providers use IRS-approved depositories with segregated, insured storage for gold and other precious metals. High-security standards and third-party audits help protect physical gold held in a gold IRA account.

Transparent Fees

Flat-rate annual IRA fees are preferable to percentage-based models. Leading gold IRA companies often waive the setup fee or storage fee in the first year and clearly disclose all charges upfront.

Responsive Support

Strong customer service is essential, especially for first-time gold IRA investors. Look for gold IRA companies with knowledgeable teams that offer guidance without pressure throughout the gold IRA investing process.

Opening a Gold IRA: A Step-by-Step Guide

Setting up a Gold IRA is a straightforward process when working with a reputable provider. Here’s a step-by-step overview of what to expect.

Submit Your Application

Begin by completing an application with basic personal information, proof of identity, and a Social Security number. Most providers also require naming a beneficiary.

Fund Your IRA Account

Choose from three main funding methods: a direct cash contribution, a rollover from a 401(k) or similar plan, or a transfer from an existing IRA. The custodian typically manages the paperwork and ensures compliance with IRS rollover guidelines.

Choose Your Precious Metals

After funding, select IRS-approved gold coins or bars—typically 99.5% pure or higher. Custodians or advisors can assist in choosing metals that align with investment goals and timelines.

Arrange for Secure Storage

The custodian ships the metals to an IRS-approved depository with insured, secure storage. Some companies allow selection of storage location based on geographic preference.

Monitor Account Performance

Track account activity and adjust as needed. Annual contributions within IRS limits help grow the investment over time.

Required Paperwork

Setup typically involves a Gold IRA application, self-directed IRA agreement, and a funding or rollover form. Completing these takes about 10–15 minutes, and full account activation is generally completed within a few business days.

Frequently Asked Questions

Can I move my current IRA into a Gold IRA?

Yes. Existing IRAs can be transferred into a Gold IRA via a tax-free rollover or direct transfer. When completed within IRS guidelines, this process avoids taxes and penalties.

Are there tax consequences?

Gold IRAs follow standard IRA tax rules. Traditional accounts offer tax-deferred growth, while Roth accounts allow tax-free withdrawals in retirement, depending on eligibility.

Where is the gold physically stored?

All IRA-approved gold must be held in an IRS-approved depository. Home storage is not permitted. Delaware Depository is among the most trusted options for secure, insured storage.

Final Thoughts

Navigating Gold IRA options is essential for long-term financial stability. While Augusta Precious Metals is known for transparency and reliability, the best provider depends on personal goals and risk tolerance. Comparing fees, storage, products, and support helps investors build a balanced retirement strategy with confidence.

>>> Click here to learn more about American Hartford Gold <<<