Us Money Reserve Reviews

If you’ve ever considered stable investment options for retirement, you’re likely aware of the enduring value of gold, silver, and other precious metals. These assets have long served as a hedge against inflation and economic uncertainty, making them a popular choice for safeguarding IRAs.

Historical events like the 2008 financial crisis and the COVID-19 pandemic provide clear examples. While many investments plummeted during these turbulent periods, precious metals not only held their value—they often increased in worth.

For those considering a precious metals IRA, partnering with a reputable investment company is a smart move. One firm that has recently gained attention is US Money Reserve.

With over two decades of experience and a diverse range of investment and storage solutions, US Money Reserve presents itself as a strong option for many investors. Let’s dive deeper into what this company offers to see if it lives up to its reputation.

>>> Click here to learn more about Us Money Reserve Reviews <<<

At a Glance: US Money Reserve

US Money Reserve: Quick Company Snapshot

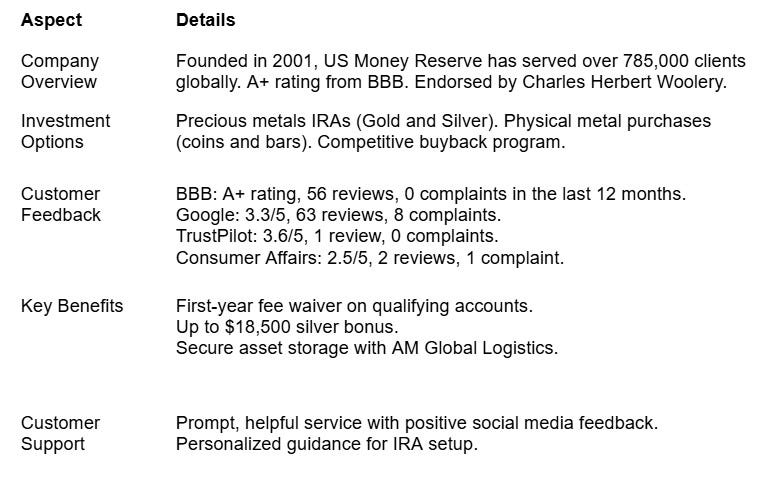

US Money Reserve has built a solid reputation in the precious metals IRA space since its founding in 2001. Over the years, it has reportedly served more than 785,000 clients worldwide—an impressive track record that reflects its reach and experience.

This longstanding history, coupled with an A+ rating from the Better Business Bureau, lends the company a level of credibility that many investors may find reassuring. Adding to its public image, US Money Reserve is also endorsed by well-known American game show host, Charles Herbert Woolery.

But beyond endorsements and accolades, what really matters is the customer experience. So, let’s take a look at what actual clients are saying about US Money Reserve.

Customer Feedback and Ratings

Why Choose US Money Reserve?

While initial impressions of US Money Reserve based on available data are generally favorable, it may not be sufficient to justify a full recommendation without further evaluation. So, a deeper evaluation was conducted into the services they offer and see how they compare to other precious metal IRA companies I’ve reviewed in the past. Here’s what I found:

Full-Service Precious Metals IRAs

For many investors, US Money Reserve’s most attractive offering is its comprehensive precious metals IRA. Fortunately, the company delivers a secure and dependable gold and silver IRA experience, complete with all the essential features seasoned investors expect.

Noteworthy aspects of their IRA service include:

A silver bonus of up to $18,500

First-year zero-fee promotion for rollover accounts over $25,000 or new accounts over $6,000

A competitive buyback program to ensure liquidity when you need it

Based on available customer feedback and service analysis, setting up a precious metals IRA with US Money Reserve is a smooth and straightforward process — whether you're rolling over an existing 401(k) or starting fresh. Much of this convenience can be credited to the company's dedicated Account Executives, who assist customers every step of the way.

Variety of Metal Investment Options

If you’re more interested in owning physical metals rather than setting up an IRA, US Money Reserve offers a wide selection of gold and silver coins and bars. Orders placed through their online shop are typically delivered within 5–10 business days, making the purchasing process quick and easy.

Some standout items from their catalog include the Gold American Buffalo, Silver American Eagle, and the commemorative Pearl Harbor silver coins. For bar enthusiasts, they also carry gold and silver bars ranging in size from 1 ounce to 1 kilogram (2.2 pounds).

What’s even better is that all these offerings are priced at competitive market rates, further enhancing the company’s appeal for both novice and seasoned investors.

Safe and Secure Asset Storage

Security is understandably a major concern for anyone trusting a company with their retirement assets. In this area, US Money Reserve demonstrates a strong commitment to safety by partnering with A-M Global Logistics (AMGL), a well-respected name in secure precious metal storage with nearly 50 years of industry experience.

With AMGL handling the safekeeping of IRA metals, investors can rest easy knowing their assets are in capable hands.

Trusted Buyback Commitment

A reputable precious metal company should offer more than just sales — it should also provide a clear and reliable way to liquidate assets. US Money Reserve meets this standard by offering a straightforward buyback policy for any precious metals it has sold to clients.

Also, certified coins can be returned within 30 days of purchase for a full refund, minus shipping, handling, and insurance costs. This added flexibility makes US Money Reserve a more trustworthy choice for investors who value liquidity.

Educational Resources and Financial Tools

While experienced investors might easily grasp the nuances of precious metal IRAs, those new to this space need a bit more guidance. Fortunately, US Money Reserve offers a robust educational suite designed to bring newcomers up to speed.

Resources include informative articles and easy-to-follow video content. One standout feature is their diversification quiz, which tailors its recommendations based on your current investments, future goals, and economic concerns. After completing the quiz, users receive a personalized Gold Information Kit via email — a thoughtful touch for those just beginning their investment journey.

Outstanding Client Support

Even though no major user-reported issues were identified while navigating US Money Reserve’s website, Customer service responsiveness was tested and found to be prompt and helpful. The company’s responsiveness reflects positively on its support standards.

Feedback from user interactions with the company’s social media teams has generally been positive on platforms like Facebook, Instagram, and X (formerly Twitter), which speaks to the company’s overall commitment to providing excellent support across channels.

Pricing and Associated Fees

One area where US Money Reserve could improve is in the transparency of its fee structure. The company’s website notes that fees may vary depending on the size of the account and the type of precious metals selected, but it doesn’t provide clear, upfront details.

That said, based on research, it appears that the typical annual fee is around $250.

On a more positive note, US Money Reserve does offer a first-year fee waiver for qualifying accounts. If you roll over or transfer at least $25,000 — or open a new account with a minimum of $6,000 — you may be eligible to have these fees waived for the first year.

How to Start Investing with US Money Reserve

After thoroughly evaluating US Money Reserve’s offerings, The company appears to provide two primary ways for investors to get started:

Direct-to-Home Delivery

One option is to purchase physical precious metals and have them delivered directly to your home, allowing you to store them securely on your own terms. The process is straightforward:

Visit US Money Reserve’s online shop and select the precious metals you wish to purchase.

Click “Add to Cart” and choose the desired quantity.

Proceed by clicking “Begin Checkout” followed by “Proceed to Checkout.”

You can either create an account or continue as a guest using your email address.

Finally, enter your shipping and payment details to complete the order.

Once your purchase is finalized, you can expect delivery within 5 to 10 business days. Just be sure to have a secure storage plan in place ahead of time to protect your investment once it arrives.

Setting Up a Precious Metals IRA

The second—and perhaps more strategic—option is to open a precious metals IRA. What sets this method apart is the personalized support US Money Reserve provides. Each investor is paired with a dedicated Account Executive who guides them through the entire setup process from start to finish.

You can connect with an Account Executive in one of two ways:

Click the “Get Started” button on US Money Reserve’s IRA webpage

Call the company directly at 1-866-646-8465

According to various reviews, both methods are equally efficient and provide prompt access to expert assistance.

Can US Money Reserve Be Trusted?

In short — yes, US Money Reserve appears to be a reliable and trustworthy option for both precious metal purchases and IRA investments. Based on the research and experience, there are no red flags when it comes to customer service or the handling of client funds. This confidence is echoed in the overwhelmingly positive reviews the company has received online.

What further reinforces my trust is how proactively US Money Reserve addresses customer concerns. On the Better Business Bureau website, I found 18 notable complaints — all of which were resolved within a day or two. That level of responsiveness speaks volumes about their commitment to customer satisfaction.

Advantages and Drawbacks

Here’s a concise overview of my take on US Money Reserve after reviewing its services, performance, and customer experience:

Benefits

Backed by over 20 years of industry experience and a strong reputation

Offers hassle-free rollovers for existing 401(k) accounts

Provides a wide selection of gold and silver coins and bars

Features comprehensive educational tools to support informed investing

Makes liquidation of precious metal assets simple through a trusted buyback program

Offers secure, insured home delivery with tracking for peace of mind

Limitations

Lacks transparent pricing details for fees on its official website

Does not currently offer platinum or palladium investment options

Final Thoughts

All things considered, US Money Reserve earns my recommendation as a trustworthy option for anyone interested in purchasing precious metals or setting up a precious metals IRA.

A notable strength of the company is — from browsing products to setting up an IRA, the experience is designed to be investor-friendly. The diverse selection of coins and bars is an added bonus, appealing to both serious investors and collectors alike.

That said, it is advisable for prospective investors before committing any portion of your savings to a precious metal IRA — whether with US Money Reserve or any other provider. And if you're still weighing your options, feel free to check out my in-depth guide on the best gold IRA companies or the top precious metal firms of 2025.

>>> Click here to learn more about Us Money Reserve Reviews <<<

Frequently Asked Questions

Can I roll over my 401(k) into a US Money Reserve Gold IRA?

Yes, US Money Reserve assists customers with existing 401(k) accounts in rolling them over into a precious metals IRA. Their team provides step-by-step guidance to make the transition as smooth as possible.

What types of metals can I purchase from US Money Reserve?

US Money Reserve offers a selection of both gold and silver in various forms, including coins and bars. These are available for both direct purchase and IRA investment.

Is there a minimum purchase requirement with US Money Reserve?

Yes, but it varies based on your payment method. For credit card transactions, there’s no minimum purchase, though you're limited to $10,000 in total purchases per calendar month. For bank wire transfers, the minimum purchase is $1,000 with no upper limit.